Centi has led the definition of a new payment standard that can be used for digital cash, tokens, and stablecoins. This standard will play a significant part in Centi’s modern, faster, cheaper, and user-friendly payment capabilities which benefit consumers and merchants alike.

Current electronic payment methods, while fairly stable can be a labyrinth or maze of increasingly complicated sequences of instructions to follow in order to finally approve payment transactions. This is especially notable with current regular checkout processes.

One such complication for both consumers and merchants is the inability to handle micropayments efficiently which leads to urging the consumer to opt for a different payment method or to increase the value of their purchase to meet the minimum required value of the selected payment choice. This creates a dilemma for both the consumer and merchant as it could potentially result in the loss of sales and consumer confidence.

To counter payment complications required foresight that considered the needs of both consumers and merchants, and Centi now provides the solution.

The New Payment Standard

In association with over 20 experts from around the world, Centi helped shape the Bitcoin (BSV) Association’s new payment standard which addressed the needs of consumers and merchants to increase consumer confidence and direct merchant accessibility.

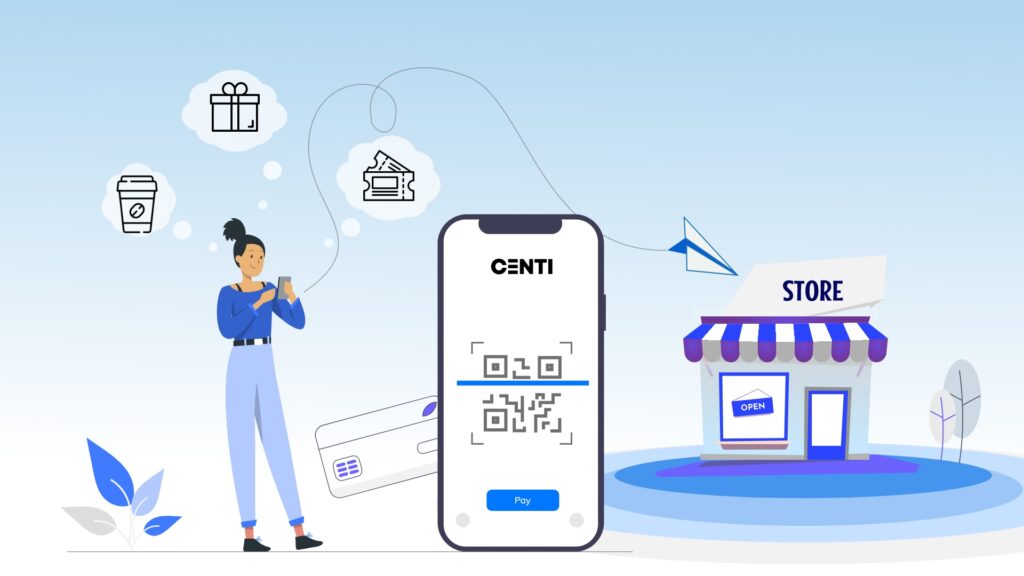

The user-friendly portal created by Centi allows merchants to set up their acceptance of various vouchers, loyalty points, and discount codes directly for payments to be collected.

Centi’s rational approach to a deep-seated problem

The first step was to define and create a standard protocol for the implementation of payment requests to promote conformity among all payment businesses in the industry. With this standard protocol in place, new businesses will be able to adopt the service with relative ease.

The second consideration was very important as it directly affects consumers and businesses. Consumers typically accumulate tokens like loyalty points, gift vouchers, and so on when they make payments, but these tokens were normally restricted to the specific card or app of the merchant.

The change is that consumers will no longer need to keep track of all these cards and apps as Centi can be used as a form of full or partial payment with multiple vendors. Different types of tokens can be accepted for payments and combinations of money and discount vouchers can be used for payments with a single press of a button.

These types of payment structures add a great deal of flexibility to payment requests and consumers will only be given the appropriate payment options derived from their wallet content which simplifies and speeds up the whole payment process.

These combinations of payment variations are rather unique and will have a positive impact on how voucher and coupon systems currently operate. In essence, what Centi has accomplished is to integrate loyalty points, vouchers, coupons, and other benefits from various merchants into one user interface and allow them to be used without lengthy check out processes or entering of codes.

The Portal is designed to attract small and medium-sized merchants to initiate their own promotions and loyalty schemes as a means to increase their customer base and revenue. All merchants will be able to set up their own terms and conditions for the issuance and acceptance of such benefits.

Customer freedom is an ingredient for growth

E-commerce is fast becoming the preferred method of purchasing and paying for goods and services. Cryptocurrencies fall into the realm of E-commerce and Bitcoin has been a pioneer in this endeavour. Centi provides a secure payment experience that makes life so much easier for both consumers and merchants.

With Centi customers control their own wallets. In this way, customers are not locked into a system but are free to manage their wallets and they can monitor their entire blockchain transaction history at the same time which offers greater control, flexibility, and trust.

Return addresses are included on invoices that allow for easy refunds, rebates, and promotions. Customers can easily use their cash-back rewards and other benefits. We are convinced Centi provides the best experience and will be the preferred choice for consumer payments!

The new payment standard integrates well with other industry standards and thus continues Bitcoin’s legacy of providing an honest and transparent global digital cash system.

A few last words

Centi has focused on giving consumers more control and privacy with less transaction fees and customers can conduct cash transactions without the need to reveal their identity much the same as paying with actual cash in a store.

Merchants are charged very affordable fees on their transactions and in return get to enjoy a plethora of value-add features accessible through the Centi Portal. Most importantly, these features can drive additional revenue to their businesses and help them build a loyal customer base.

Digital cash is the definitive solution to many of today’s consumer payment problems and Centi is the ideal catalyst to tackle them one by one!