In this article CENTI wants to zoom out and let you in on how to put our recent announcements into perspective regarding payments. CENTI is about to bring some unique features to the industry. Don’t miss the announcement about licensing STAS token technology from TAAL nor our most recent post about working with Vaionex to deliver next-generation wallet infrastructure.

The digital age has ushered in a limitless multitude of innovations. Thanks to the brilliant work of engineers, data scientists, mathematicians, and creative professionals, many people are now enjoying the fruits of this hard work and unparalleled craftsmanship. Whether it be banking or cryptocurrencies, or from E-commerce to everyday retail transactions, indeed, everyday life has become easier and more manageable because of these innovations.

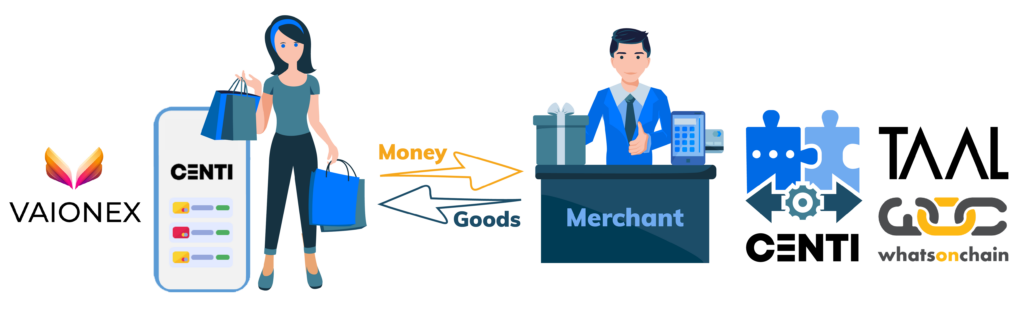

At CENTI we want to ensure that transactions can happen as cash transactions wherever possible. The reasons we do this are simple. More control and privacy on the consumer side and less transaction fees which we have to impose on merchants on the business integration side. The reason fees are lower with CENTI compared to debit and credit cards is that cash can be accepted without charge-back risks and it can be accepted without identification of the consumer.

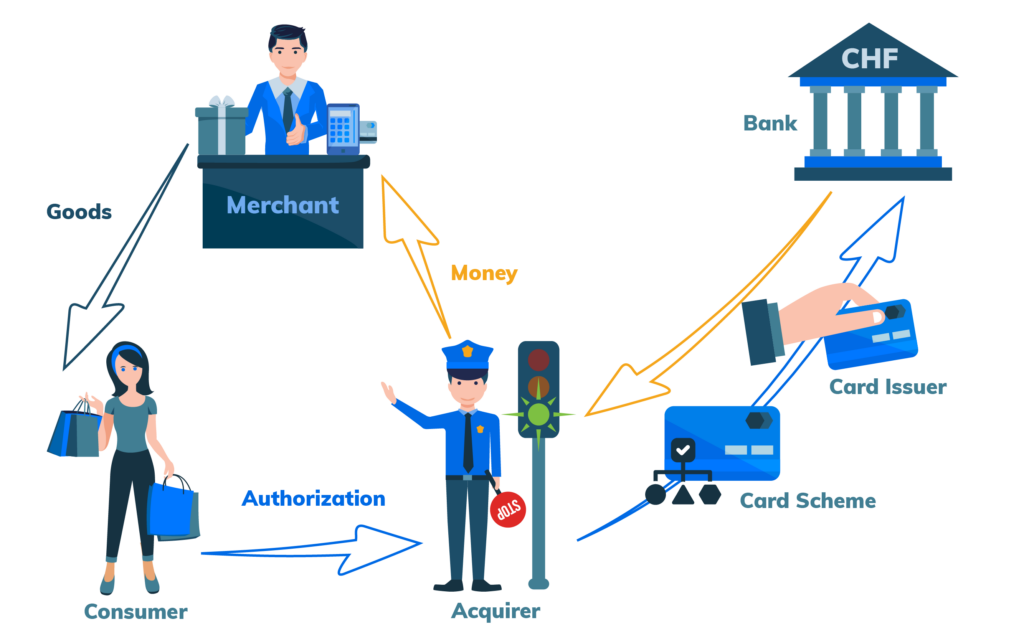

To exemplify this, consumers don’t have to show an ID to purchase a pack of gum for cash at the local kiosk. However, if they paid with a debit card or credit card, they would need to be fully identified as the transaction is in that scenario is a 3-party monetary flow where the consumers authorize the card company to deduct from their account or write to their credit line, the card company in return tells the merchant that he can let the consumer go with the product and the merchant gets settled later by the card company. Consumer identification, which is a legal prerequisite to taking part in any such 3-party transaction, is done when the card is issued and the cost for ID check and issuance is imposed on the merchants through fees. Merchants of course pass on the fees through their product pricing.

On the flip side, physical cash is also expensive to handle. It can be counterfeited which poses a risk but even if it is genuine, it has to be counted multiple times and transported before the merchant gets money on his bank account to e.g. pay employees or suppliers. The reasons fees are lower with CENTI than with physical cash are zero risk of counterfeits, fully digital accounting for the cash and transportation costs which are negligible compared to the costs of transporting physical cash.

CENTI aims to combine the best of both worlds, cash payments and electronic payments resulting in electronic cash payments. Consumers and merchants get all the advantages of cash without the tedious counting or counterfeit checking combined with the simplicity, convenience and hygiene of electronic payments.

In order to ensure compatibility with regulations concerning cash transactions, the most important aspect is not to create a 3-party payment triangle as described above. All regulatory advantages for cash are only at play, if the requested amount is within cash limits and the transaction at hand can happen directly from the consumer to the merchant. Instead of the triangle model, CENTI works more like a bucket-chain; a chain of bilateral transactions.

Every technology choice we make at CENTI is carefully considered regarding this key differentiator we have against virtually any other electronic means of payment which is widely accepted today.

Bitcoinsv as well as STAS-tokens, which are a form of Bitcoinsv activated through a smart contract invented by Bitcoin-Script-Engineer Stas Trock, can be technically and legally used as electronic cash (limitations apply depending on the legal nature of the issued tokens). Direct consumer to merchant payments are very common In the BitcoinSV ecosystem. In such a transaction the consumer hands the merchant the signed transaction who then accepts it after doing the relevant checks about the authenticity. The merchant may use any methods he sees fit to check for authenticity. Similar to physical cash, there is no single right way to do it. They could contract a cash handling service to do it for them or just hold the bill against the light and check for security details. Of course CENTI is here to run these checks on the merchants behalf and on top we also offer direct conversion services such that merchants conveniently get their money on the bank account just like with any other electronic payment.

When it comes to checking for transaction authenticity and handling the incoming transactions as a service provider to our merchants, CENTI has contracts in place with the top players in the ecosystem in order to provide best in class value-add services and can thus guarantee the payments instantly. We will let you know below about the most prominent of players and services we work with to build the CENTI offering, but at this point we remark that any of these 3rd party services, as well as the products CENTI itself provides, can be replaced by other parties. CENTI is a handler for electronic cash for our merchants. The cash we handle is not issued by CENTI and does not rely on CENTI to function either. The free wallet we plan to offer on the consumer side could likewise be replaced or supplemented by another wallet.

But what sense does it make that we let merchants and consumers know that they could technically replace us?

Only if the consumer and merchant side can be substituted by other compatible solutions can a transaction be considered to be a cash transaction in nature. As soon as a central party is introduced which authorizes the actual payment process, the transaction becomes of the same nature as a credit or debit card transaction.

Secondly, we want our CENTI consumers and business partners to know that we strive to deliver the best service to you as we are in constant competition with others offering the same or similar services!

The STAS-technology licensed from TAAL allows us to offer our merchants the issuance of tickets, loyalty points, vouchers, coupons, prepaid balances, dedicated local currencies, stablecoins, promotional tokens and many more things which can then flow bi-directionally on top of the very same base technology we already offer for payments which is Bitcoinsv. With this technology CENTI can literally offer digital paper printing technology to it’s merchants which we will do with great care. If a merchant prints a voucher or a coupon on paper the merchant is the contractual counterparty and he could also hire another printer for this job.

CENTI is convinced all merchants will enjoy working with us as we take care of the security, interface and extra value-add services for you.

The industry experts we work with understand our vision and each of them provide services very close to their core business for us:

The Vaionex Corporation, a leader when it comes to innovations in the Bitcoinsv ecosystem, has built several platforms which directly interact with the Bitcoinsv blockchain. Vaionex’s backend wallet services are among the fastest in the industry and built to scale from the very beginning. Vaionex is heavily involved in building the CENTI consumer wallet app and parts of the backend of the CENTI wallet will be shared with Vaionex. Rest assured though, that the little data we do collect from our CENTI consumers rests securely on Swiss servers with the highest certification standards regarding security and privacy available in the industry today.

WhatsOnChain is the leading block explorer for Bitcoinsv and also provides a set of API’s and tools which are very useful and in use across the industry. The company was acquired by TAAL in the year 2020 but continues to operate under the WhatsOnChain brand. STAS-token transactions are regular Bitcoinsv transactions but they have been minted and are thus linked to an issuer and an issuing event at some point in time. In order to check a transaction quickly for its authenticity in a retail situation, WhatsOnChain keeps a set of all unspent STAS-tokens and their IDs such that CENTI and other wallet applications can check the authenticity of the transacted tokens in real time. Further WhatsOnChain has developed a software development toolkit for the STAS-technology which makes it easier for wallet operators to integrate STAS.

TAAL is a leader in blockchain data processing infrastructure. TAAL’s uniqueness in the markets lies in its hybrid approach in the fields of blockchain services, network infrastructure, and software. CENTI licenses the STAS-technology from TAAL which allows converting generic Bitcoinsv into minted tokens with a unilateral issuance contract. Further CETNI sources transaction services from TAAL which will enable consumers using the CENTI wallet to use STAS-tokens without the requirement to own any Bitcoinsv. We are convinced that consumers just want great products without hassle and these services allow us to provide just that. This collaboration is a clear win-win with both parties having clear incentive to provide the best services and grow the Bitcoinsv ecosystem.

In full synergy with Vaionex, WhatsOnChain and TAAL, CENTI believes that utilizing the Bitcoinsv blockchain will allow its users to enjoy and truly make the most of this innovative payments solution. Designed to seamlessly accept Bitcoinsv and tokens , CENTI is THE definitive and integrated experience of digital cash.

Subscribe to the CENTI newsletter to stay updated and receive regular updates about the CENTI mobile wallet as well as CENTI merchant services.